The Best Loan Management Software Companies in the UK

Since our recent blog post on how to start a loans company, we have received a lot of enquiries by people looking to start a new business in the payday and guarantor sector. Very often, we are also asked what is the best loan management software for lenders and with several companies in the UK offering their services, we wanted to give you an overview of the different companies that we recommend.

Our Recommended and Best Loan Software Vendors

1. Optalitix – https://www.optalitix.com/

Optalitix is a Camden-based innovation company which has worked with a number of companies offering loans and finance, including startups and challenger banks.

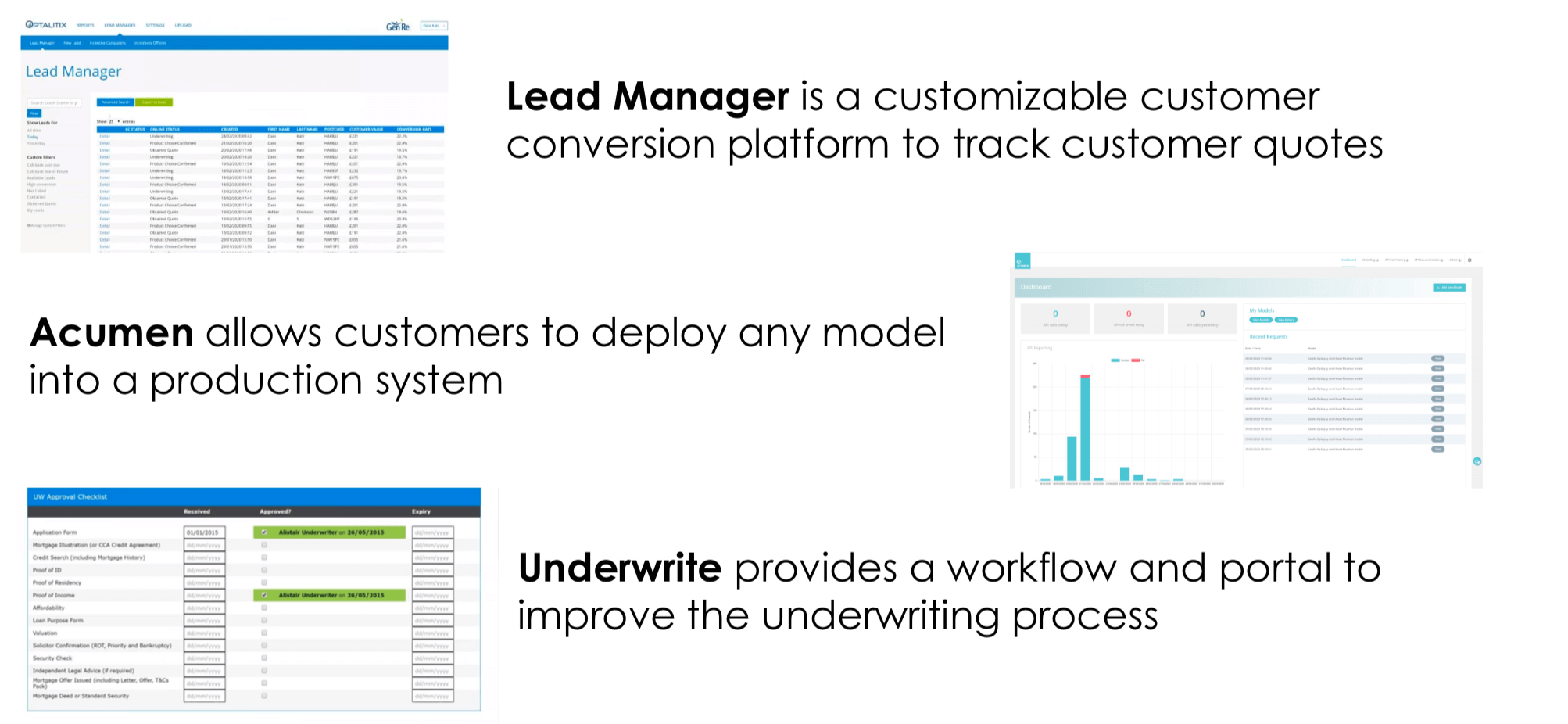

The company has a full suite of products, available only by contacting them directly, which includes a full Leads Manager, Acumen system to incorporate any model into your system and Underwrite, a portal that provides a simple workflow for your all your applications coming in and how they are progressing.

Optalitix are more of a data-driven company than those below – and they will be able to provide powerful insights into your data and help you scale your loans business, using AI or machine learning if there is scope to do so.

For more information, email info@optalitix.com

2. Laps IT – http://www.laps-it.com/

LAPS is based in Fareham, in between Portsmouth and Southampton and stands for Loan Application Processing System. They are one of the most established software companies in the payday and short term lending industry, offering the full service from loan application to repayments and a one-touch integration with merchant account gateways and the credit reference agencies like CallCredit.

To prevent fraud, they have tools to prevent multiple loans being authorised and high levels of fraud risk.

The entire application process is nicely automated, including scheduled collection payments from debit cards and the use of third party services for authorisation, verification and credit searches.

Their integration allows an easy connection between affiliate marketers and Pingtrees, allowing you to create custom links and track them for each application. Each lender gets a complete audit trail so they have locate any notes and data concerning each individual customer transaction.

3. Anchor – https://www.anchor.co.uk/

![]()

Anchor are based in Wales and experienced with guarantor lenders and companies offering instalment credit. Anchor is made up of their Sentinel and Journeyman systems.

Sentinel is made up of five models and provides the requirements for loan proposals, administration, direct debits, financial accounts and collections.

The Journeyman is a little different and enables collections by other agents and is used for revolving credit sales, hamper sales, and video and TV rental, as well as use by credit unions. Both Sentinel and Journeyman can be managed on a user’s premises or accessed as a hosted solution over the web.

4. BrightOffice – https://www.brightoffice.co.uk/

![]()

Lancashire-based BrightOffice offer a cloud-based solution to loan management software. Their system is more like a CRM and lets companies act as brokers or direct lenders and work as multiple providers – so perfect if you have sub brands or sister companies.

The application offers standards-based connectivity (XML) with other systems to handle the exchange of information and documents. Secure online document storage allows easy liaisons with solicitors, banks and underwriters and it is all stored digitally. The audit trail allows all lending activities to be tracked and enable good compliance with the FCA’s practices of responsible lending.

The BrightOffice software can be white-labeled by the lender to correlate with their brand look and colours. Bright Office also offers marketing tools using email, conventional post and mobile messaging (SMS) to capture new and existing customers.

What You Need From A Loan Software

Product offering: Some loan software vendors specialise in particular products such as affiliate, lead generators and comparison models and these are used for introducing loans as an intermediary. The other options operate as direct lenders which involves taking the application, underwriting the loan and funding it. The companies we recommend below are able to assist with:

- payday, logbook and guarantor loans

- peer to peer loans

- credit unions

- hire purchase

- bridging and commercial property finance

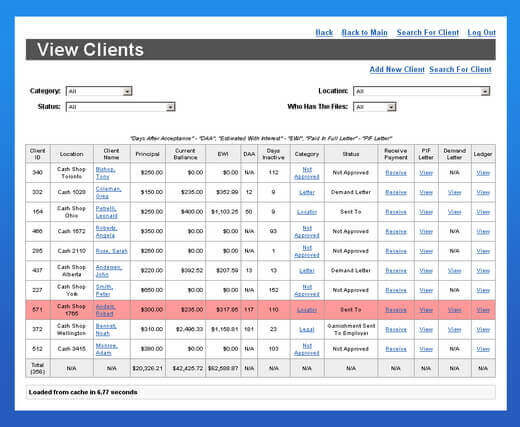

Good back-end platform: Customer service advisors, underwriters and all stakeholders will be using the back-end on a constant basis to see the loans coming in and out. It needs to be user friendly so that all levels of computer experience can operate it. This platform should allow staff to see and operate every aspect of a loan from the application from customer details, decisions, funding, collections and more.

Feed of applications: A good software should allow loan applications to be seen in real-time and for them to be easily accessible to customer service agents and can be allocated accordingly. Think of your newsfeed on Facebook or a list of names, the loan applications are updated as they come in.

Decision engine: Once a customer applies, their application will automatically run through the decision engine of the software and this should be carried out in a matter of seconds. This is how customers know whether they have been declined or provisionally approved once an application is complete. You’ve heard all the marketing about ‘get a quote in seconds’ and this is how it works.

The decision engine will include basic requirements such as residential and employment status, credit checking and affordability. It is typically based on scores and the criteria of the loan provider. The engine should allow the integration of a credit reference agency like Experian or Equifax to run a check on a customer in mini-seconds.

A good software platform should allow for the decision rules to be tweaked easily by the lending as they make adjustments to their risk profile and who they are willing to accept. This also includes making changes to the application form in a robust way. The last thing you want is to have the changes made by developers who need weeks and weeks of sign-off. Having the freedom to make changes yourself is first prize.

Funding facility: As a loans company, you will need to fund successful applicants. Some loan softwares have payment facilities built in so that you can fund the loans immediately and some require the integration of an additional payment platform e.g Stripe or GoCardless. Depending on the software and payment system you use, it will determine whether or not you can fund loans in 15 minutes, on the same day, weekday or before 5pm.

Notes: Part of running a loans business that is regulated by the Financial Conduct Authority, you are required to keep notes of every interaction that you have with a customer. So part of your customer service and underwriting procedures, you need a software that allows you to make notes and find them if you are questioned. It also allows you to make references to previous engagements and conversations you have had with the customer and ensure that you can provide a good service.

Calculations: A good system allows you to make calculations based on the different loans for the customer. So depending on the customer’s criteria (credit score, residential status), loan duration or type of product, the software must be able to calculate the APR and formulate repayments plan easily for the staff and the customers to see.

Loan Documents: Customers must be able to see the loan agreements prior to one being funded. These are usually provided in an online document once the applicant has been provisionally approved. The documents will adhere to the FCA’s requirements and also show the terms of the loan e.g loan amounts, repayment dates, cancellation policy etc. Customers will usually electronically sign this, known as an E-sign, which includes clicking on a email link and receiving an SMS pin code to confirm the customer’s contact details and identity.

Triggers: These are the automatic messages that get sent to a customer by email and SMS at every stage of the application and loans process. These messages can say things like ‘follow here to complete your application’ and ‘your next collection is due next week.’ Having the right triggers in place is key for running a compliant loans company and ensuring customers will complete applications and repay on time.

Security: With so much personal data and information at stake, it is essential to find a software that has sophisticated security measures in place. Most companies give you the option to keep the servers on your own premises or you have a hosted solution where you connect your business to the software companies through the Internet or cloud.

Obviously, any breaches of data for the business or company can have catastrophic effects. This can make the lender and their customers hugely vulnerable to fraud, fines and lawsuits, so having security in place is very important.

Reporting: Senior staff in particular are always interested in the reporting and understanding the numbers gives the firm an idea of their progress and potential. This includes the customer details, number of applications, funded, repaid and defaulted. This could be available in bespoke reports by the software vendor or by downloading a report in an Excel or CSV format. Some softwares can incorporate accountancy programmes like Sagepay which ideal for the finance and accounting teams.

Scalability: Ultimately, successful loan companies thrive on funding and collection volumes of loans. So at the end of the day, you require a platform that allows for scalability including the ability to handle large volumes of applications, funded loans, users and making regular changes to your products and decision rules.

Advice: Finally, if you are a startup or new loans company, it can be great to have advice from a software provider who can assist you every step of the way. They are likely already going to be working with lots of lenders and know how to run a successful loan company in a regulated environment.

The Cost Of Loan Softwares and Ways To Save Money

Based on the quotes we have received, the cost of lending platform is based on:

- Integration

- Monthly fees

The integration can range from a one-off fee of £15,000 to £50,000 depending on the vendor you use and complexity of the financial product. This can be paid in instalments of different sizes to help spread your repayment (ironic for a lender)!

The monthly fees can be based on a licensing subscription model of around £2,000 to £3,000 a month or based on a cost per application that the machine has to process.

The ways to save money on your set up include limiting the number of customer service advisors, as you sometimes have to pay more for every extra login. Other cost considerations include whether you have the service hosted as you have to weigh up the costs of having your own server or using the loan management software company. You can always consider giving the vendor a stake in your business to reduce the initial set up costs or working on a revenue share or target basis.

Create Your Own Loan Software

For some companies, especially the large ones, they see the value to create their own platforms. This is common for the likes of Wonga and Amigo or those that offer additional loan products and want to integrate them altogether.

The reason for creating their own software is to save on costs from a vendor and have more freedom to create a bespoke system, perhaps integrating big CRMs like Salesforce in the process. If you have the means to employ developers in house, then this could be the approach for you, although it is likely to be very costly in the short run, especially for a new start-up.